This is Corey Jones with to be ready with safety man podcast. Join us every week for a new podcast, follow us everywhere podcasts are played and on YouTube be ready with safety man this is Corey Jones all right welcome to safety man podcast. Safety man podcast be ready with safety man. I am safety man.co Corey Jones, and I'm here with EDA hoary Anthony. What's up, what's up back for this is our 12th episode together. You know that oh my goodness, it's been a year. Man, it's been a full year we're lasting longer than most marriages. Is true. So you uh suggested today's topic. Uh, we've been kind of just seeing what you know. We've kind of been making a plan of what we want to do on podcasts. And all of a sudden I think kind of the world just dictates for us, what's going on. So you had a good idea what do we get going on. Yeah, so again like you alluded to, we want to be relevant right, and people are asking a lot of questions about getting gun permits and carrying a firearm for protection. So we're going to try to cover a lot of it and I might be preempting you when I say this, but I have to say it too. Please don't take anything that we're saying here as legal advice. Please don't go get a gun and say that safety man podcast said that you could do that. All right. We're trying to give advice and direct you to where the information is, but we want to guide you, so you don't waste time, effort, and money, and then realize that maybe you couldn't do that. That's what we're going to talk about today. And you got two firearm instructors here with probably about 40 years of combined firearms training experience and questions asked and answered and...

PDF editing your way

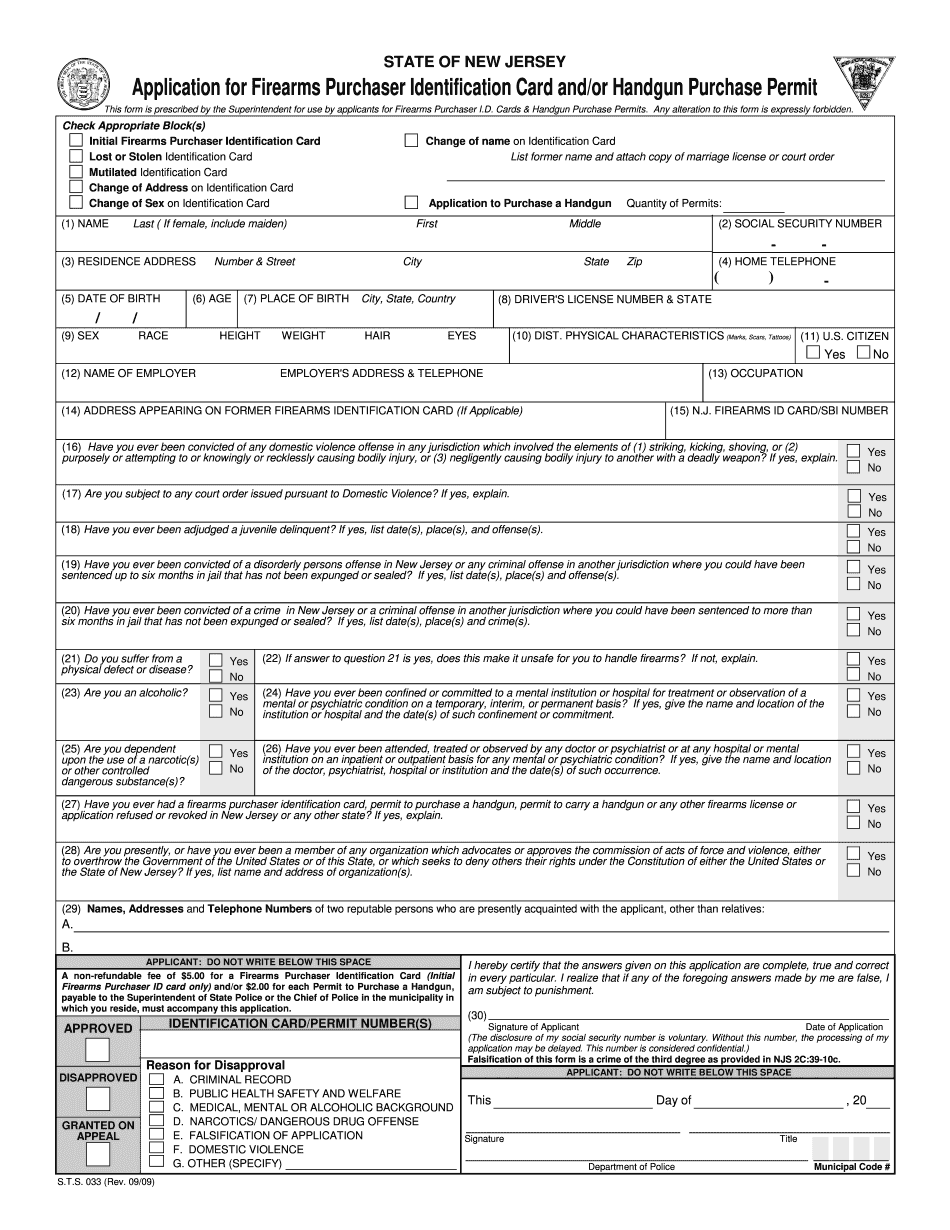

Complete or edit your NJ STS 33 2009 Form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export NJ STS 33 2009 Form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your NJ STS 33 2009 Form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your NJ STS 33 2009 Form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare NJ STS 33 2025 Form

About NJ STS 33 2025 Form

NJ STS 33 2025 Form refers to the New Jersey Division of Taxation's Sales and Use Tax Exempt Organization Certificate. This form is required to be filled out by organizations seeking exemption from sales and use tax on purchases made in the state of New Jersey. The NJ STS 33 2025 Form is specifically designed for nonprofit organizations that qualify for exemption from sales and use tax. These organizations include charitable, educational, religious, and governmental entities. By completing and submitting this form, these organizations can obtain a certificate that allows them to make tax-exempt purchases for their exempt purposes within the state. The form requires organizations to provide their legal name, address, federal employer identification number (FEIN), type of organization, and a detailed explanation of their exempt purpose. Additionally, organizations must provide proof of their tax-exempt status, such as a copy of their IRS determination letter. Any nonprofit organization in New Jersey that seeks exemption from sales and use tax on purchases must fill out the NJ STS 33 2025 Form accurately and submit it to the New Jersey Division of Taxation. This ensures that they can benefit from the tax exemption and avoid paying unnecessary taxes on eligible purchases.

Online remedies allow you to manage your own file supervision and improve the output of one's work-flows. Continue with the speedy guide to complete NJ STS 33 2025 Form, prevent problems and adorn the idea in a timely manner:

How to perform any NJ STS 33 2025 Form on the web:

- On your website with the template, just click Begin right now as well as pass towards the editor.

- Use the particular indications for you to fill out the kind of career fields.

- Add your own info and contact files.

- Make certain one enters appropriate info along with quantities inside appropriate job areas.

- Wisely confirm the content in the document as well as sentence structure as well as transliteration.

- Go to Assistance segment for those who have questions as well as handle our own Help group.

- Place a digital trademark on your NJ STS 33 2025 Form with the help of Sign Instrument.

- As soon as the form is finished, push Completed.

- Send your all set file by means of e-mail as well as facsimile, printing it out or save on your system.

PDF rewriter enables you to make modifications in your NJ STS 33 2025 Form from the net linked unit, customize it in accordance with your needs, sign that electronically and deliver in different ways.

What people say about us

The increasing need for digital forms

Video instructions and help with filling out and completing NJ STS 33 2025 Form